Yo, we’re diving into the epic showdown of 401(k) vs. IRA. Get ready for some serious money talk that’ll have you seeing dollar signs!

Comparison of 401(k) and IRA

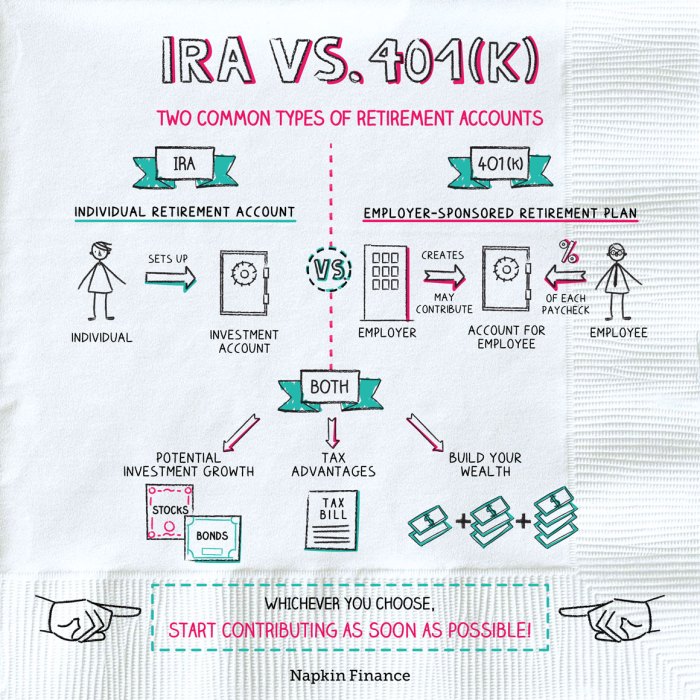

When it comes to saving for retirement, understanding the differences between a 401(k) and an IRA is crucial. Each of these accounts has its own unique features that cater to different needs and circumstances.

Key Differences

- A 401(k) is an employer-sponsored retirement account, while an IRA is an individual retirement account that you can open on your own.

- 401(k) plans often come with matching contributions from employers, providing an additional boost to your savings.

- IRAs offer more investment options and flexibility compared to 401(k) plans.

- 401(k) contributions are made through payroll deductions, while IRA contributions are made directly by the account holder.

Eligibility Requirements

- To participate in a 401(k) plan, you typically need to be employed by a company that offers this benefit.

- IRAs are available to anyone with earned income, regardless of whether they have access to a workplace retirement plan.

- Income limits may apply for certain types of IRAs, such as Roth IRAs.

Contribution Limits

- For 2021, the annual contribution limit for 401(k) plans is $19,500, with an additional catch-up contribution of $6,500 for those aged 50 and older.

- IRAs have a lower contribution limit of $6,000 per year for 2021, with a $1,000 catch-up contribution for individuals aged 50 and above.

- It’s important to note that these limits can change annually, so it’s essential to stay updated on the current figures.

Types of 401(k) and IRA

When it comes to 401(k) and IRA accounts, there are various types to choose from, each with its own unique features and benefits. Let’s dive into the different options available for both 401(k) and IRA accounts.

Types of 401(k) Plans

- Traditional 401(k): This is the most common type of 401(k) plan where contributions are made on a pre-tax basis, reducing your taxable income.

- Roth 401(k): Contributions to this plan are made after-tax, allowing for tax-free withdrawals in retirement.

- Solo 401(k): Designed for self-employed individuals, this plan allows for higher contribution limits compared to traditional 401(k) plans.

Types of IRAs

- Traditional IRA: Contributions to this account are typically tax-deductible, with taxes paid upon withdrawal during retirement.

- Roth IRA: Contributions to a Roth IRA are made after-tax, and qualified withdrawals in retirement are tax-free.

- SEP IRA: Simplified Employee Pension IRAs are ideal for small business owners and self-employed individuals, offering higher contribution limits.

Each type of 401(k) and IRA account has its own set of advantages and considerations, so it’s important to choose the one that aligns best with your financial goals and retirement plans.

Tax Advantages and Withdrawals

When it comes to tax advantages and withdrawals, understanding the differences between a 401(k) and an IRA can help you make informed decisions for your financial future.

Tax Advantages of 401(k) vs. IRA

- Contributions to a 401(k) are made with pre-tax dollars, meaning you can lower your taxable income for the year. This can result in immediate tax savings, as you won’t pay taxes on the amount you contribute until you withdraw the funds during retirement.

- On the other hand, contributions to a Traditional IRA are also tax-deductible, providing similar benefits of lowering your taxable income. However, Roth IRA contributions are made with after-tax dollars, but you can withdraw the funds tax-free during retirement.

Early Withdrawal Rules and Penalties

- With a 401(k), if you withdraw funds before the age of 59 ½, you may face a 10% early withdrawal penalty on top of paying income taxes on the amount withdrawn. There are some exceptions to this rule, such as certain hardships or qualified medical expenses.

- For an IRA, early withdrawals before the age of 59 ½ are also subject to a 10% penalty, along with income taxes. However, there are exceptions for first-time home purchases, higher education expenses, or certain medical costs.

Tax Implications of Withdrawals During Retirement

- When you start withdrawing funds from a 401(k) during retirement, the amount you take out is taxed as ordinary income. This means you’ll pay taxes on the withdrawals based on your tax bracket at that time.

- On the other hand, withdrawals from a Traditional IRA are also taxed as ordinary income. However, withdrawals from a Roth IRA during retirement are tax-free, as long as certain conditions are met.

Employer Matching and Investment Options

When it comes to retirement savings, understanding the concept of employer matching contributions in 401(k) plans is crucial. These matching contributions are essentially free money that your employer puts into your retirement account based on a percentage of your own contributions.

Employer matching can significantly impact your decision between a 401(k) and an IRA. If your employer offers a matching program, it’s usually a good idea to take advantage of it as it can help boost your retirement savings faster.

Employer Matching Contributions in 401(k) Plans

- Employer matching contributions are typically a percentage of your own contributions, up to a certain limit.

- Matching contributions are usually subject to a vesting schedule, which means you may have to stay with the company for a certain period of time before you fully own those funds.

- Not taking advantage of employer matching is like leaving money on the table – it’s essentially free money that can grow over time.

Investment Options Comparison

- 401(k) plans often have a limited selection of investment options predetermined by the employer or plan provider.

- IRAs, on the other hand, offer a wider range of investment options, including individual stocks, bonds, mutual funds, and more.

- Having more investment options in an IRA gives you greater control over your investment decisions and potential for higher returns.