Crypto arbitrage trading strategies involve capitalizing on price differences in various markets to generate profits efficiently. From triangular to spatial arbitrage, these strategies leverage speed and technology to stay ahead in the crypto trading game.

Exploring the nuances of these strategies can provide valuable insights into the dynamic world of cryptocurrency trading.

Overview of Crypto Arbitrage Trading Strategies

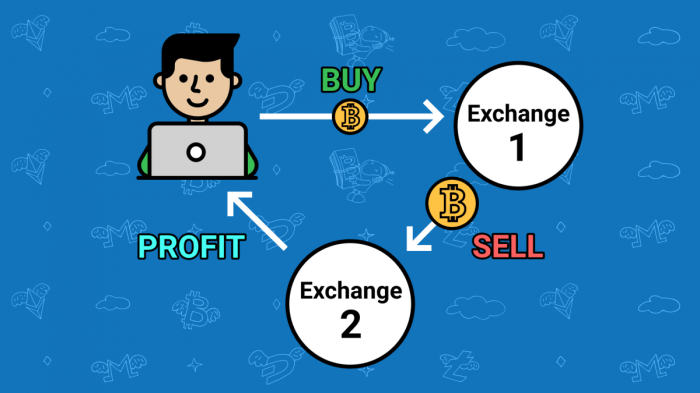

Crypto arbitrage trading involves taking advantage of price differences for the same asset in different markets. Traders buy the asset at a lower price in one market and sell it at a higher price in another market, profiting from the price differential.Price differences in different markets can occur due to various factors such as supply and demand dynamics, liquidity levels, and trading volume.

These differences create opportunities for arbitrage traders to make profits by exploiting the inefficiencies in the market.Speed and technology play a crucial role in arbitrage trading as prices can change rapidly, and opportunities for arbitrage may arise and disappear within seconds. Traders need to have fast and reliable trading systems that can execute trades quickly to capitalize on these opportunities before they vanish.

Types of Crypto Arbitrage Trading Strategies

Cryptocurrency arbitrage trading involves taking advantage of price differences in various markets to make a profit. There are different strategies that traders can use to capitalize on these opportunities.

Triangular Arbitrage in the Crypto Market

Triangular arbitrage is a popular strategy in the crypto market that involves taking advantage of price discrepancies between three different cryptocurrencies. The basic idea is to trade one cryptocurrency for another, then another, and finally back to the original cryptocurrency, making a profit in the process. This strategy requires quick execution and careful monitoring of prices to ensure profitability.

Spatial Arbitrage and How It Is Executed

Spatial arbitrage involves exploiting price differences between the same cryptocurrency on different exchanges. Traders can buy the cryptocurrency on one exchange where the price is lower and sell it on another exchange where the price is higher, pocketing the price difference as profit. This strategy requires efficient transfer of funds between exchanges and constant monitoring of price differentials.

Statistical Arbitrage and Its Relevance in Crypto Trading

Statistical arbitrage is a strategy that involves using statistical models to identify mispricings in the market. Traders look for patterns or anomalies in price movements to make trades that are expected to be profitable. In the crypto market, statistical arbitrage can help traders identify opportunities for profit by analyzing historical price data and market trends. This strategy requires a deep understanding of statistical analysis and the ability to interpret data accurately.

Tools and Technologies for Crypto Arbitrage Trading

Cryptocurrency arbitrage trading requires specific tools and technologies to be successful. These tools help traders identify price differences across different exchanges and execute profitable trades.

Essential Tools for Effective Arbitrage Trading

- Real-time Price Tracking Software: Tools that provide up-to-date price information across multiple exchanges.

- Exchange Accounts: Accounts on various cryptocurrency exchanges to facilitate buying and selling.

- Wallets: Secure digital wallets to store cryptocurrencies during trades.

- Trading Capital: Sufficient funds to capitalize on arbitrage opportunities.

Automated Trading Bots vs. Manual Trading Strategies

Automated trading bots are programs that can execute trades automatically based on predefined parameters. They are efficient in scanning multiple exchanges quickly and executing trades at optimal times. On the other hand, manual trading strategies require human intervention and decision-making, which may lead to delays in capitalizing on arbitrage opportunities. While bots can operate 24/7, manual trading is limited by human availability and response time.

Role of APIs in Executing Arbitrage Trades, Crypto arbitrage trading strategies

APIs (Application Programming Interfaces) play a crucial role in executing arbitrage trades by enabling communication between different exchanges and trading platforms. APIs allow traders to access real-time data, execute trades, and manage their accounts programmatically. By leveraging APIs, traders can automate the process of arbitrage trading and reduce the time it takes to identify and capitalize on profitable opportunities.

Risks and Challenges in Crypto Arbitrage Trading: Crypto Arbitrage Trading Strategies

Cryptocurrency arbitrage trading comes with its own set of risks and challenges that traders need to be aware of in order to navigate the volatile market successfully. Let’s dive into some of the common risks associated with arbitrage trading and the challenges that traders may encounter.

Common Risks Associated with Arbitrage Trading

- Price Discrepancies: One of the key risks in arbitrage trading is the possibility of price differences between exchanges, leading to potential losses if not executed quickly and accurately.

- Execution Risks: Delays in executing trades can result in missed opportunities or losses, especially in fast-moving markets.

- Counterparty Risks: Traders face the risk of default by the counterparty, which can impact the overall profitability of the arbitrage trade.

Liquidity Issues and Impact on Arbitrage Opportunities

- Liquidity plays a crucial role in arbitrage trading, as low liquidity can hinder the ability to quickly buy and sell assets across different exchanges.

- High volatility combined with low liquidity can result in slippage, where the actual execution price differs from the expected price, affecting the profitability of arbitrage opportunities.

Regulatory Challenges Faced by Arbitrage Traders

- Regulatory uncertainty in the cryptocurrency market poses challenges for arbitrage traders, as different jurisdictions may have varying regulations or restrictions on trading activities.

- Compliance with anti-money laundering (AML) and know your customer (KYC) regulations can add complexity to arbitrage trading and require traders to navigate regulatory requirements carefully.