Budgeting for Families takes center stage in this financial journey, where we explore the ins and outs of managing money like a boss. Get ready for a crash course in family finance that’s anything but boring!

From setting financial goals to teaching kids about money, we’ve got all the tips and tricks you need to rock your family budget. So, buckle up and let’s dive into the world of smart money moves!

Importance of Budgeting for Families

Budgeting is crucial for families as it helps them manage their finances effectively, plan for the future, and achieve their financial goals. By setting a budget, families can track their income and expenses, prioritize their spending, and avoid debt and financial stress.

Benefits of Having a Budget for Family Finances

- Helps families save money for emergencies and unexpected expenses.

- Allows families to allocate funds for important priorities such as education, healthcare, and retirement.

- Encourages communication and teamwork among family members when it comes to financial decisions.

- Reduces unnecessary spending and promotes responsible financial habits.

Examples of How Budgeting Can Positively Impact Family Life

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

- By budgeting, families can plan for fun activities and vacations without overspending or going into debt.

- Budgeting can help families stay organized and on top of their bills, preventing late payments and fees.

- Having a budget can reduce financial conflicts and arguments within the family, leading to better relationships and less stress.

Creating a Family Budget

Planning and managing a budget for your family is crucial to ensure financial stability and achieve your financial goals. Here are the steps to create a family budget along with different budgeting methods suitable for families and tips on setting financial goals within a family budget.

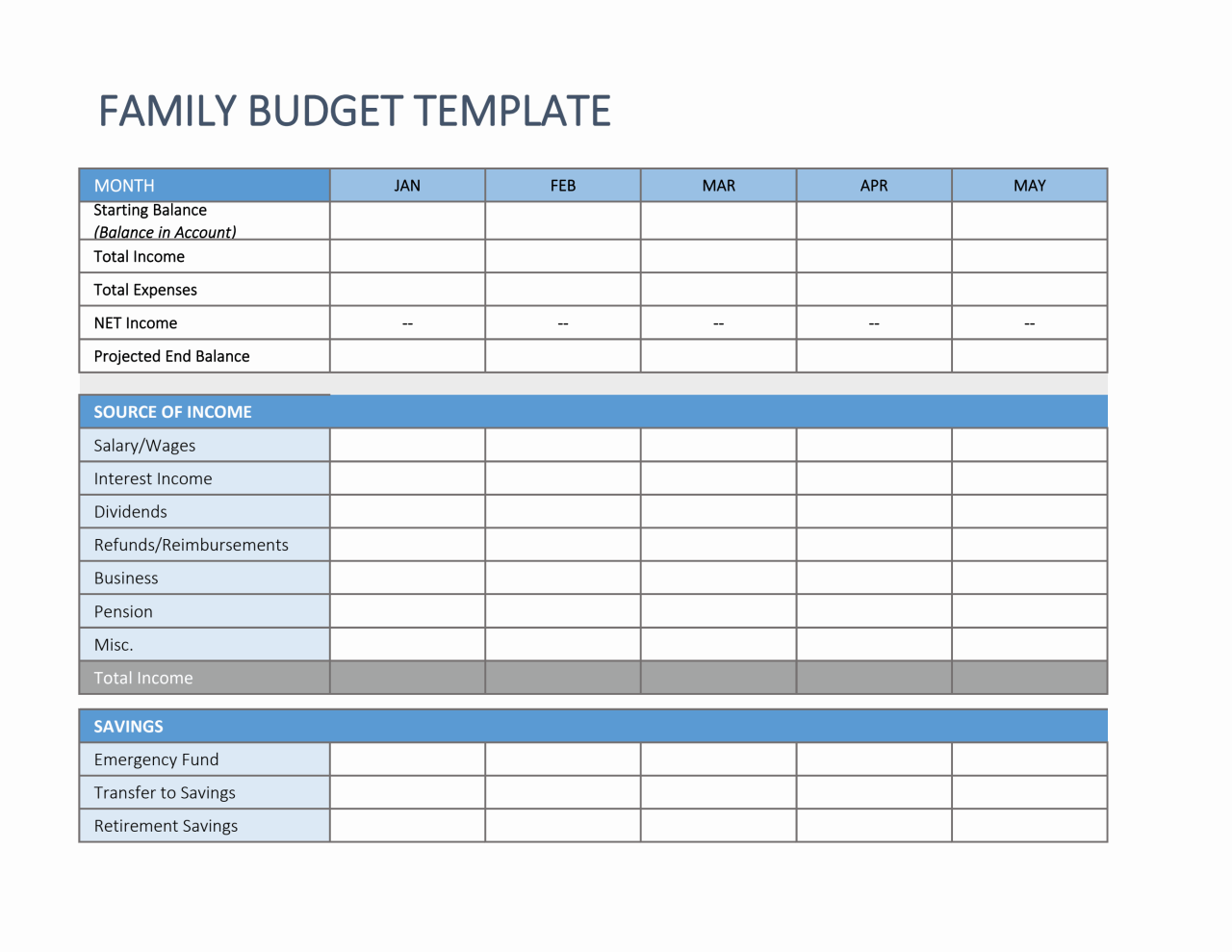

Steps to Create a Family Budget

- List all sources of income: Include all income sources like salaries, bonuses, and any other earnings.

- Track expenses: Monitor all expenses, including bills, groceries, utilities, and other regular payments.

- Set financial goals: Determine short-term and long-term financial goals for your family.

- Create budget categories: Divide expenses into categories like housing, transportation, food, and entertainment.

- Allocate funds: Assign a specific amount to each category based on priority and necessity.

- Review and adjust: Regularly review your budget, track spending, and make adjustments as needed.

Different Budgeting Methods for Families

- Traditional budgeting: Assign fixed amounts to different expense categories.

- Zero-based budgeting: Allocate every dollar of income to expenses, savings, or debt repayment.

- Envelope system: Use cash for different categories and place money in envelopes to limit spending.

- Percentage-based budgeting: Allocate a percentage of income to different expense categories.

Tips on Setting Financial Goals within a Family Budget

- Start with short-term goals: Set achievable goals like building an emergency fund or paying off credit card debt.

- Include long-term goals: Plan for major expenses like buying a house, saving for your children’s education, or retirement.

- Make goals specific and measurable: Define clear objectives and set a timeline to track progress.

- Discuss goals as a family: Involve all family members in setting financial goals to create accountability and shared commitment.

- Celebrate milestones: Acknowledge achievements along the way to stay motivated and maintain financial discipline.

Managing Family Expenses

When it comes to managing family expenses, it’s essential to track and plan for various costs to ensure financial stability. By identifying common expenses, finding ways to cut down on unnecessary costs, and handling unexpected expenses, families can stay on top of their budget and achieve their financial goals.

Common Family Expenses to Include in Your Budget

- Housing costs, including rent or mortgage payments

- Utilities such as electricity, water, and gas

- Food expenses, including groceries and dining out

- Transportation costs, like gas, car payments, and public transportation

- Healthcare expenses, including insurance premiums and medical bills

- Childcare or education costs for children

- Debt payments, such as credit card bills or student loans

Strategies for Cutting Down on Unnecessary Expenses

- Create a detailed budget and track your spending regularly to identify areas where you can cut back

- Avoid impulse purchases and stick to a shopping list when buying groceries or other items

- Look for ways to reduce utility costs by using energy-efficient appliances and turning off lights when not in use

- Consider meal planning and cooking at home to save money on dining out

- Shop for deals, use coupons, and compare prices before making major purchases

Handling Unexpected Expenses within a Family Budget

- Build an emergency fund to cover unexpected costs like car repairs or medical emergencies

- Consider getting insurance coverage for major expenses like health issues or home repairs

- Adjust your budget and cut back on discretionary spending temporarily to accommodate unexpected costs

- Communicate openly with your family about financial challenges and work together to find solutions

Teaching Kids about Budgeting

Teaching kids about budgeting is crucial for their financial literacy and future success. By involving children in family budget discussions, parents can instill important money management skills from a young age.

Importance of Involving Children in Budget Discussions

It is essential to involve children in budget discussions as it helps them understand the value of money and the importance of making informed financial decisions. By including kids in budget planning, parents can teach them about setting financial goals, prioritizing spending, and saving for the future.

Age-Appropriate Ways to Educate Kids about Budgeting

- Start with simple concepts like distinguishing between needs and wants.

- Give them an allowance to manage and encourage saving and budgeting.

- Use real-life examples to explain budgeting, like planning for a family outing or saving for a toy.

- Introduce basic budgeting tools like jars or envelopes for different spending categories.

Long-Term Benefits of Teaching Kids about Financial Responsibility

- Children who learn about budgeting early on are more likely to develop good money habits as adults.

- Teaching kids about financial responsibility can help them avoid debt and make smart financial choices in the future.

- Kids who understand budgeting are better equipped to handle financial challenges and emergencies later in life.

Saving and Investing for Families: Budgeting For Families

When it comes to saving and investing for families, it’s essential to have a solid financial plan in place to secure your future. By prioritizing saving and making smart investment decisions, families can work towards achieving their financial goals and building wealth over time.

Tips for Saving Money within a Family Budget, Budgeting for Families

One of the best ways to save money within a family budget is to set specific savings goals. Whether it’s saving for a vacation, a new home, or your children’s education, having clear objectives can help you stay motivated and focused on your financial priorities.

- Track your expenses and identify areas where you can cut back.

- Automate your savings by setting up regular transfers to a savings account.

- Look for ways to reduce utility bills and other recurring expenses.

- Shop smart by using coupons, buying in bulk, and comparing prices before making purchases.

Different Investment Options Suitable for Families

When it comes to investing for families, it’s important to consider your risk tolerance, time horizon, and financial goals. Here are some investment options suitable for families:

- Stocks: Investing in individual stocks or exchange-traded funds (ETFs) can offer long-term growth potential.

- Bonds: Bonds are a more conservative investment option that can provide steady income and stability to a family’s portfolio.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Real Estate: Investing in rental properties or real estate investment trusts (REITs) can provide passive income and potential appreciation over time.

Strategies for Building an Emergency Fund

Building an emergency fund is crucial for families to handle unexpected expenses or financial setbacks without derailing their long-term financial goals. Here are some strategies for building an emergency fund:

- Set a specific savings goal for your emergency fund, such as three to six months’ worth of living expenses.

- Automate contributions to your emergency fund each month to ensure consistent saving.

- Keep your emergency fund in a separate high-yield savings account for easy access in case of emergencies.

- Avoid using your emergency fund for non-emergencies to maintain its purpose and effectiveness.